Free Tax Preparation and Filing Assistance 2026

Palm Beach VITA Sites

The Taxes Filed Free Initiative provides free, confidential, and secure preparation and e-filing of tax returns to qualified taxpayers. To qualify, the taxpayer’s income must have been $78,000 or less in Palm Beach County and $67,000 or less in the Treasure Coast Counties in 2025.

Taxpayers may be eligible for up to $8,046 in Earned Income Tax Credits (EITC).

Taxes Filed Free gives you two options to choose from to e-file your tax return. All options are supported by IRS-Certified Volunteer Income Tax Assistance (VITA) volunteers. All VITA sites accommodate individuals with a disability. The VITA sites are grouped by region of the county and listed alphabetically by city.

Filed For You – Face-to-face tax preparation provided at several county VITA sites, no appointment required. For more information and/or to find a nearest location visit www.TaxesFiledFree.org or call 211.

Filed Yourself – Visit www.MyFreeTaxes.com and file your own tax return. It’s simple, fast, and secure. If you have a tax or software related question, you can submit a question by email, webchat, or call the helpline for support.

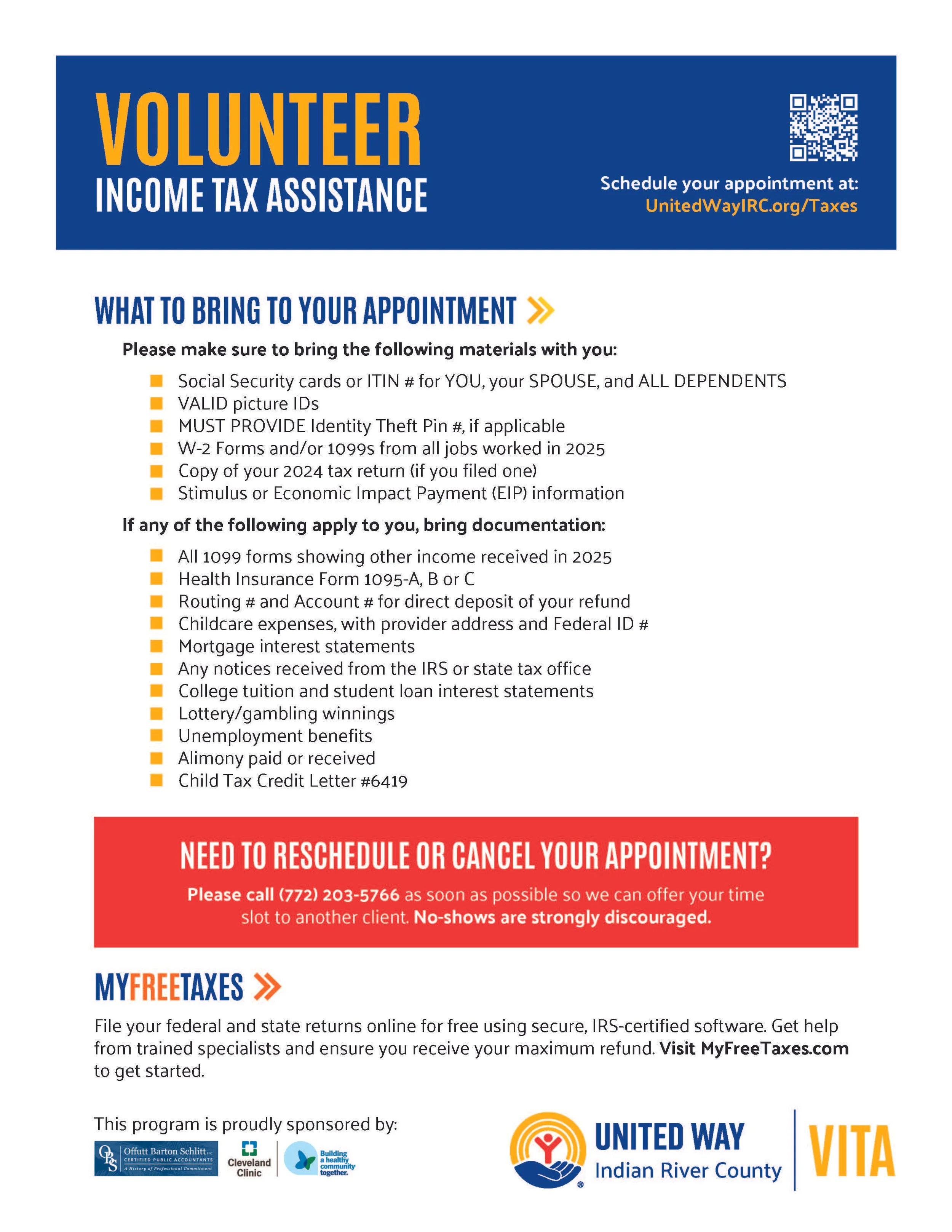

Please bring the following items to the VITA site to make it easier to prepare your return:

· Last year’s Federal Income Tax Return (2024 income tax return)

· Social Security Cards for you, your spouse (if married), and all dependents

· Correct birth dates for all names that appear on the return

· All W-2’s for 2025, including spouses

· Payroll statement or last paystub from employer that shows overtime amount paid during 2025

· Form 1098 – Mortgage interest, property taxes

· Form 1099 – DIV, G, INT, MISC, Q, R, RRB, SSA for 2025

· Voided check and savings account number for direct deposit of your refund (This is optional, but it

gets your cash to you fast)

· A Photo ID card (driver’s license, etc.), including spouse’s, if married and filing joint returns

· For Dependent Care Credit, bring care provider’s name, address, SSN/EIN, and amount you paid

· For Education Credit, bring 1098T or 1098E and amount paid for qualified expenses

· For Premium Tax Credit, bring 1095-A (Health Marketplace Statement)

If married and filing a joint return, both spouses must come to the VITA site.

VITA volunteers will NOT prepare Schedule D (Complex), Schedule E, Employee Business Expenses, Moving Expenses and Nondeductible IRA.

*Please note that United Way of Palm Beach County administers the VITA program locally. They will be providing a list of sites once all are confirmed. This should be available in January…

Download the List of Palm Beach County 2026 Tax Sites Here

VITA Taxes Filed Free in Palm Beach County- program starts Monday, January 26th – Wednesday, April 15th (note: some sites close prior to the 15th). Unless otherwise specified- no appointment necessary. Click on link above for additional site location details.

Treasure Coast 2026 VITA Free Tax Preparation Information

*Please note that the United Ways of the Treasure Coast administer the VITA program. They will be revising the content of the sites below as they are able. Information should be updated in January.

Scroll down for Indian River County, Martin County and St. Lucie & Okeechobee Counties

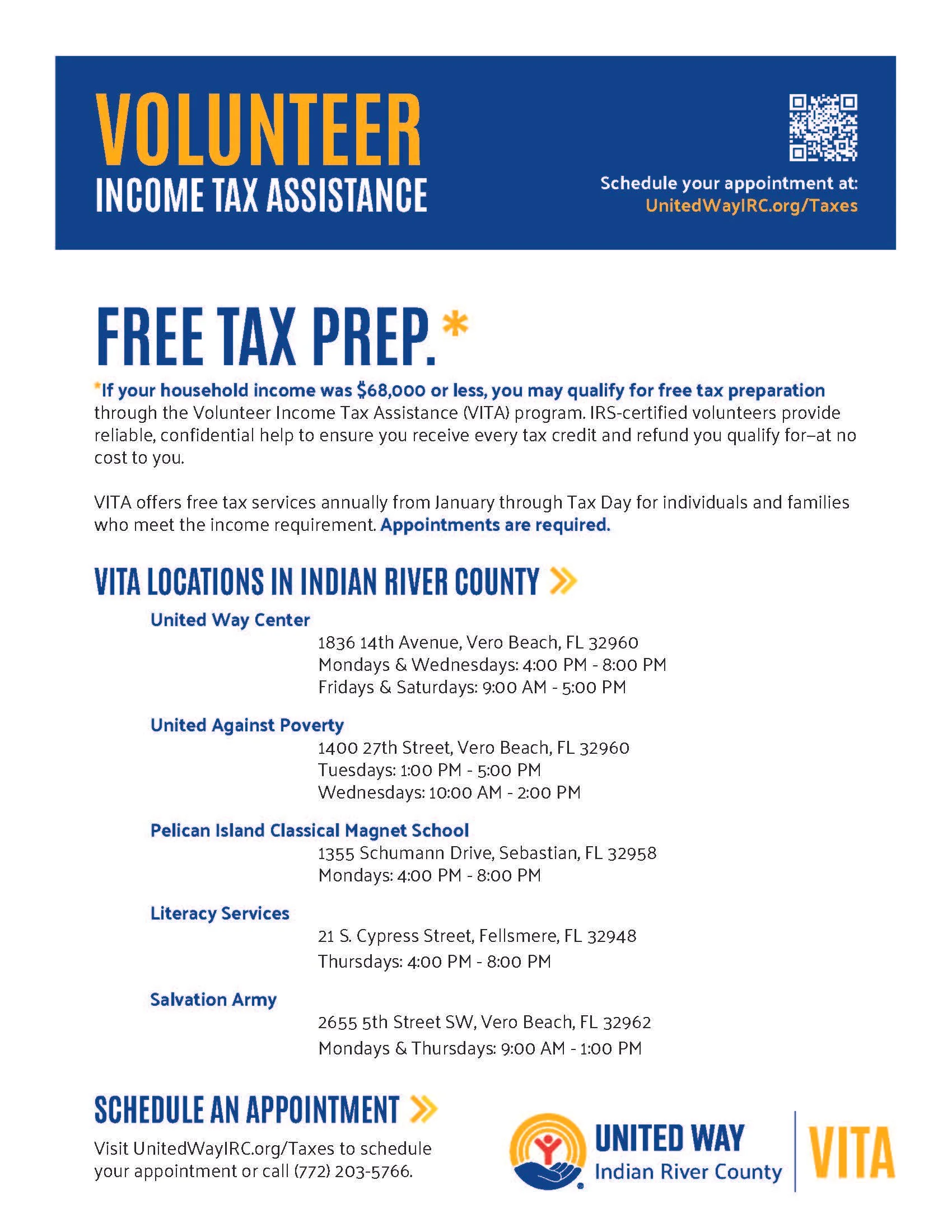

INDIAN RIVER COUNTY

United Way of Indian River County VITA By appointment only- will start will start booking appointments Monday, January 19th 2026. Schedule online by clicking link above or call (772) 203-5766. The appointments will start February 2nd.

MARTIN COUNTY

Click here for VITA free tax preparation details>>> United Way of Martin County VITA

Will be by appointment only- will start taking appointments Thursday, January 15th 2026.

* Note cannot prepare taxes wanting to claim loss through disaster- do not have the software program

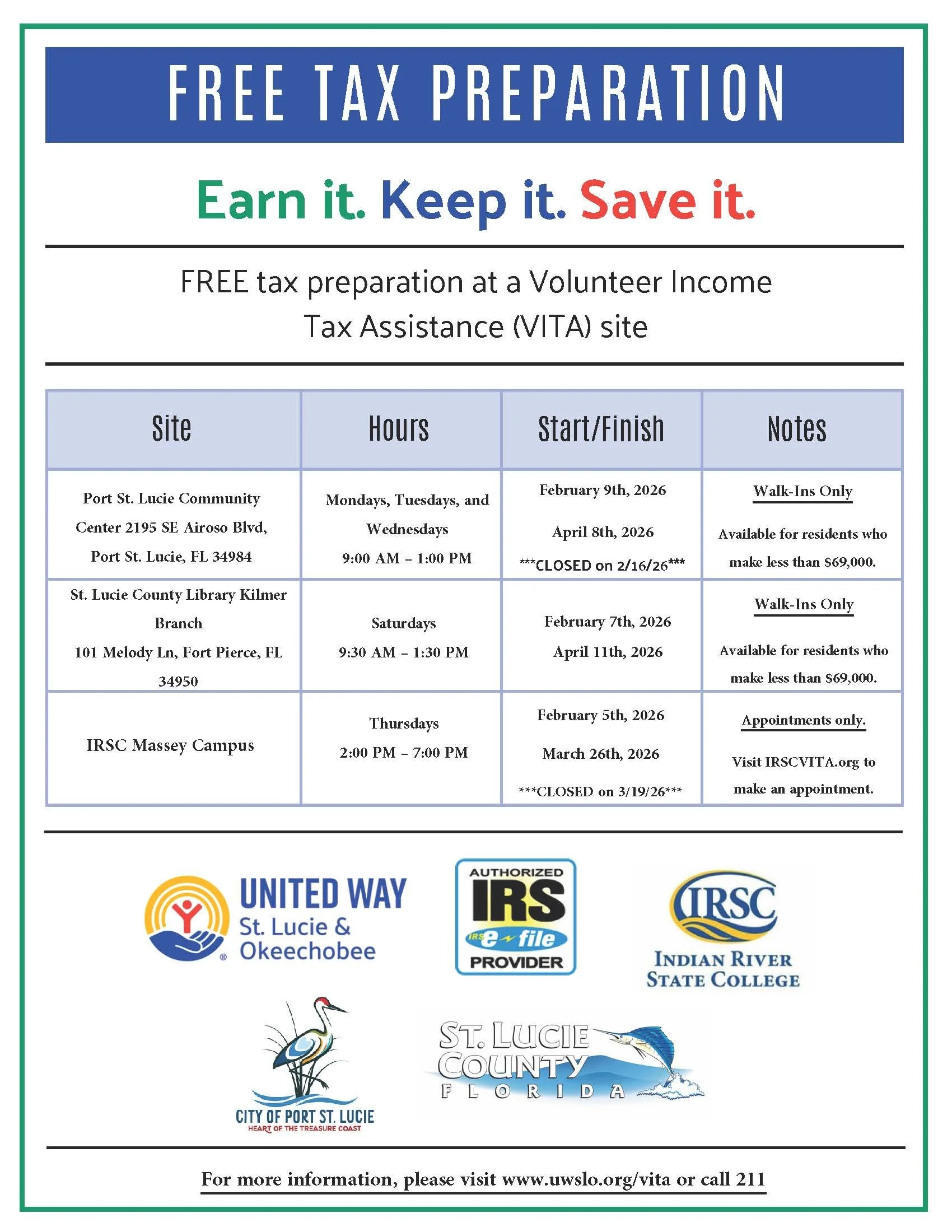

ST. LUCIE AND OKEECHOBEE COUNTIES

United Way of St. Lucie and Okeechobee

What to Bring to your VITA Appointment:

Proof of identification (photo ID).

Social Security cards for you, your spouse and dependents.

An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number.

Proof of foreign status, if applying for an ITIN.

Birth dates for you, your spouse, and dependents on the tax return.

Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers.

Interest and dividend statements from banks (Forms 1099).

Health Insurance Exemption Certificate, if received.

A copy of last year’s federal and state returns, if available.

Proof of bank account routing and account numbers for direct deposit such as a blank check.

To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms.

Total paid for daycare provider and the daycare provider's tax identifying number such as their Social Security number or business Employer Identification Number.

Forms 1095-A, B and C, Health Coverage Statements.

Copies of income transcripts from IRS and state, if applicable.

VITA locations below: